Chapter 6 T-test for Difference in Means and Hypothesis Testing

library(tidyverse)6.1 Seminar

We’ll be using the ‘quality of government’ data we used in week 4, so let’s load it. Also take a look at the codebook below to remind yourself what the variables are.

# load in quality of government data

world.data <- read.csv("https://raw.githubusercontent.com/QMUL-SPIR/Public_files/master/datasets/QoG2012.csv")| Variable | Description |

|---|---|

| h_j | 1 if Free Judiciary |

| wdi_gdpc | Per capita wealth in US dollars |

| undp_hdi | Human development index (higher values = higher quality of life) |

| wbgi_cce | Control of corruption index (higher values = more control of corruption) |

| wbgi_pse | Political stability index (higher values = more stable) |

| former_col | 1 = country was a colony once |

| lp_lat_abst | Latitude of country’s captial divided by 90 |

We can get summary statistics of each variable in the dataset by using the summary() function over the dataset.

summary(world.data) h_j wdi_gdpc undp_hdi wbgi_cce

Min. :0.0000 Min. : 226.2 Min. :0.2730 Min. :-1.69953

1st Qu.:0.0000 1st Qu.: 1768.0 1st Qu.:0.5390 1st Qu.:-0.81965

Median :0.0000 Median : 5326.1 Median :0.7510 Median :-0.30476

Mean :0.3787 Mean :10184.1 Mean :0.6982 Mean :-0.05072

3rd Qu.:1.0000 3rd Qu.:12976.5 3rd Qu.:0.8335 3rd Qu.: 0.50649

Max. :1.0000 Max. :63686.7 Max. :0.9560 Max. : 2.44565

NA's :25 NA's :16 NA's :19 NA's :2

wbgi_pse former_col lp_lat_abst

Min. :-2.46746 Min. :0.0000 Min. :0.0000

1st Qu.:-0.72900 1st Qu.:0.0000 1st Qu.:0.1343

Median : 0.02772 Median :1.0000 Median :0.2444

Mean :-0.03957 Mean :0.6289 Mean :0.2829

3rd Qu.: 0.79847 3rd Qu.:1.0000 3rd Qu.:0.4444

Max. : 1.67561 Max. :1.0000 Max. :0.7222

NA's :7 6.1.1 The Standard Error

The standard error of an estimate quantifies uncertainty that is due to sampling variability. Recall that we infer from a sample to the population. Let’s have a look at wdi_gdpc which is gdp per capita. We rename the variable to wealth.

# rename to wealth

world.data <- world.data %>%

rename(wealth = wdi_gdpc)

# check it worked

names(world.data)[1] "h_j" "wealth" "undp_hdi" "wbgi_cce" "wbgi_pse"

[6] "former_col" "lp_lat_abst"Now, have a look at the mean of the new wealth variable.

mean(world.data$wealth)[1] NAR returns NA because there are missing values on the wealth variable and we cannot calculate with NAs. For instance, 2 + NA will return NA. We make a copy of the full data set and then delete missing values. Recall that we did this before, in week 4.

# copy of the dataset

full.data <- world.data

# delete rows from dataset that have missings on wealth variable

world.data <- drop_na(world.data, wealth)Now, compute the mean of wealth again.

mean(world.data$wealth)[1] 10184.09The mean estimate in our sample is 10184.09. We are generally interested in the population. Therefore, we infer from our sample to the population. Our main problem is that samples are subject to sampling variability. If we take another sample, our mean estimate would be different. The standard error quantifies this type of uncertainty.

The formula for the standard error of the mean is: \[ SE(\bar{Y}) = \frac{s_Y}{\sqrt{n}} \]

Where \(s_Y\) is the standard deviation (of wealth) and \(n\) is the number of observations (of wealth).

We compute the standard error in R:

# standard error calculation

se.y_bar <- (sd(world.data$wealth) / # standard deviation of variable

sqrt(length(world.data$wealth))) # divided by square root of number of observations

se.y_bar[1] 922.7349The standard error is ~922.73. The mean of the sampling distribution is the population mean (or close to it — the more samples we take, the closer is the mean of the sampling distribution to the population mean). The standard error is the average difference from the population mean. We have taken 1 sample. When taking any random sample, the average difference between the mean in that sample and the population mean is the standard error.

We need the standard error for hypothesis testing. You will see why in the following.

6.1.2 T-test (one sample hypothesis test)

A knowledgeable friend tells you that worldwide wealth stands at exactly 10 000 US dollars per capita today. You would like to know whether she is right. To that end, you assume that her claim is the population mean. You then estimate the mean of wealth in our sample. If the difference is large enough, so that it is unlikely that it could have occurred by chance alone, you can reject her claim.

So, first you take the mean of the wealth variable.

mean(world.data$wealth)[1] 10184.09Wow, your friend is quite close. Substantively, the difference between your friend’s claim and your estimate is small, but you could still find that the difference is statistically significant (i.e. that it’s a noticeable systematic difference).

Because we do not have information on all countries, your 10184.09 is an estimate and the true population mean – the population here would be all countries in the world – may be 10000 as your friend claims. You can test this statistically.

In statistics jargon: you would like to test whether your estimate is statistically different from the 10000 figure (the null hypothesis) suggested by your friend. Put differently, you would like to know the probability that you estimate 10184.09 if the true mean of all countries is 10000.

Recall that the standard error of the mean (which is the estimate of the true standard deviation of the population mean) is estimated as:

\[ \frac{s_{Y}}{\sqrt{n}} \]

Before you estimate the standard error, you need to get \(n\) (the number of observations). We have done this above but to make your code more readable, you can save the number of observations in an object that you call n.

n <- length(world.data$wealth)

n[1] 178With the function length(world.data$world) you get all observations in the data. Now, take the standard error of the mean again.

# standard error calculation

se.y_bar <- sd(world.data$wealth) / sqrt(n)We know that 1 standard error is one average deviation from the population mean. The sampling distribution is approximately normal. 95 percent of the observations under the normal distribution are within 2 (1.96, to be precise) standard deviations of the mean.

You can construct the confidence interval within which the population mean lies with 95 percent probability in the following way. First, take the mean of wealth. That’s the sample mean and not the population mean. Second, go 1.96 standard errors to the left of it. This is the lower bound of the confidence interval. Third, go 1.96 standard deviations to the right of the sample mean. That is the upper bound of the confidence interval.

The 95 percent confidence interval around the sample means gives the interval within which the population mean lies with 95 percent probability.

You want to know what the population mean is, so you want the confidence interval to be as narrow as possible. The narrower the confidence interval, the more precise your estimate of the population mean. For instance, saying the population mean of income is between 9 950 and 10 050 is more precise than saying the population mean is between 5 000 and 15 000. Both would give the same mean estimate of 10,000, though.

You construct the confidence interval with the standard error. That means, the smaller the standard error, the more precise the estimate. The formula for the 95 percent confidence interval is:

\[ \bar{Y} \pm 1.96 \times SE(\bar{Y}) \]

You can now construct your confidence interval. Your sample is large enough to assume that the sampling distribution is approximately normal. So, go \(1.96\) standard deviations to the left and to the right of the mean to construct your \(95\%\) confidence interval.

# lower bound

lb <- mean(world.data$wealth) - 1.96 * se.y_bar

# upper bound

ub <- mean(world.data$wealth) + 1.96 * se.y_bar

# results (the population mean lies within this interval with 95% probability)

lb # lower bound[1] 8375.531mean(world.data$wealth) # sample mean[1] 10184.09ub # upper bound[1] 11992.65You can make this look a little more like a table like so:

ci <- cbind(lower_bound = lb,

mean = mean(world.data$wealth),

upper_bound = ub)

ci lower_bound mean upper_bound

[1,] 8375.531 10184.09 11992.65The cbind() function stands for column-bind and creates a \(1\times3\) matrix.

So you are \(95\%\) confident that the population average level of wealth is between 8375.53 US dollars and 11992.65 US dollars. You can see that you are not very certain about your estimate and most definitely cannot rule out that your friend is right (she claimed that the population mean is 10 0000 — that is within the interval). Hence, you cannot reject it.

A different way of describing our finding is to emphasize the logic of (hypothetical) repeated sampling. In a process of repeated sampling you can expect that the confidence interval that we calculate for each sample will include the true population value \(95\%\) of the time.

6.1.2.1 The t value

You can now estimate the t value. Recall that your friend claimed that the population mean was 10 000. This is the null hypothesis that you wish to falsify. You estimated something else in your data, namely 10184.0910395. The t value is the difference between your estimate (the result you got by looking at data) and the population mean under the null hypothesis, divided by the standard error of the mean.

\[ \frac{ \bar{Y} - \mu_0 } {SE(\bar{Y})} \]

Where \(\bar{Y}\) is the mean in your data, \(\mu_0\) is the population mean under the null hypothesis and \(SE(\bar{Y})\) is the standard error of the mean.

Okay, let’s compute this in R:

t.value <- (mean(world.data$wealth) - 10000) / se.y_bar

t.value[1] 0.1995059Look at the formula until you understand what is going on. In the numerator you take the difference between your estimate and the population mean under the null hypothesis. In expectation that difference should be 0 — assuming that the null hypothesis is true. The larger that difference, the less likely it is that the null hypothesis is true.

Dividing by the standard error transforms the units of the difference into standard deviations. Before transforming the units, the difference was in the units of the variable itself (US dollars in this example). By dividing by the standard error, you have normalised the variable. Its units are now standard deviations from the mean.

Assume that the null hypothesis is true. In expectation the difference between your estimate in the data and the population mean should be 0 standard deviations. The more standard deviations your estimate is away from the population mean under the null hypothesis, the less likely it is that the null hypothesis is true.

Within 1.96 standard deviations from the mean lie 95 percent of all observations. That means, it is very unlikely that the null hypothesis is true, if the difference that we estimated is further than 1.96 standard deviations from the mean. How unlikely? For this, you would need the p value, for the exact probability. However, the probability is less than 5 percent if the estimated difference is morethan 1.96 standard deviations from the population mean under the null hypothesis.

Back to the t value. We estimated a t value of 0.1995059. That means that a sample estimate of 10184.0910395 is 0.1995059 standard deviations from the population mean under the null hypothesis — which is 10 000.

This t value suggests that your sample estimate would only be 0.1995059 standard deviations away from the population mean under the null. That is not unlikely at all. You can only reject the null hypothesis if you are more than 1.96 standard deviations away from the mean.

6.1.2.2 The p value

Let’s estimate the precise p-value by calculating how likely it would be to observe a t-statistic of 0.1995059 from a t-distribution with n - 1 (177) degrees of freedom.

The function pt(t.value, df = n-1) is the cumulative probability that we get the t.value we put into the formula if the null is true. The cumulative probability is estimated as the interval from minus infinity to our t.value. So, 1 minus that probability is the probability that we see anything larger (in the right tail of the distribution). But we are testing whether the true mean is different from 10000 (including smaller). Therefore, we want the probability that we see a t.value in the right tail or in the left tail of the distribution. The distribution is symmetric. So we can just calculate the probability of seeing a t-value in the right tale and multiply it by 2.

# calculate p value

2* ( 1 - pt(t.value, df = (n-1) ))[1] 0.8420961The p-value is way too large to reject the null hypothesis (the true population mean is 10 000). If we specified an alpha-level of 0.05 in advance, we would reject it only if the p-value was smaller than 0.05. If we specified an alpha-level of 0.01 in advance, we would reject it only if the p-value was smaller than 0.01, and so on.

Let’s verify our result using the the t-test function t.test(). The syntax of the function is:

t.test(formula, mu, alt, conf)Lets have a look at the arguments.

| Arguments | Description |

|---|---|

formula |

Here, we input the vector that we calculate the mean of. For the one-sample t test, in our example, this is the mean of wealth. For the t test for the difference in means, we would input both vectors and separate them by a comma. |

mu |

Here, we set the null hypothesis. The null hypothesis is that the true population mean is 10000. Thus, we set mu = 10000. |

alt |

There are two alternatives to the null hypothesis that the difference in means is zero. The difference could either be smaller or it could be larger than zero. To test against both alternatives, we set alt = "two.sided". |

conf |

Here, we set the level of confidence that we want in rejecting the null hypothesis. Common confidence intervals are: 95%, 99%, and 99.9%—they correspond to alpha levels of 0.05, 0.01 and 0.001 respectively. |

t.test(world.data$wealth,

mu = 10000,

alt = "two.sided")

One Sample t-test

data: world.data$wealth

t = 0.19951, df = 177, p-value = 0.8421

alternative hypothesis: true mean is not equal to 10000

95 percent confidence interval:

8363.113 12005.069

sample estimates:

mean of x

10184.09 The results are similar. Therefore we can conclude that you are unable to reject the null hypothesis suggested by your friend that the population mean is equal to 10000.

6.1.2.3 Critical Values

In social sciences, we usually operate with an alpha level of 0.05. That means, we reject the null hypothesis if the p value is smaller than 0.05. Or put differently, we reject the null hypothesis if the 95 percent confidence interval does not include the population mean under the null hypothesis — which is always the case if our estimate is further than two standard errors from the mean under null hypothesis (usually 0).

We said earlier that the critical value is 1.96 for an alpha level of 0.05. That is true in large samples where the distribution of the t value follows a normal distribution. 95 percent of all observations are within 1.96 standard deviations of the mean.

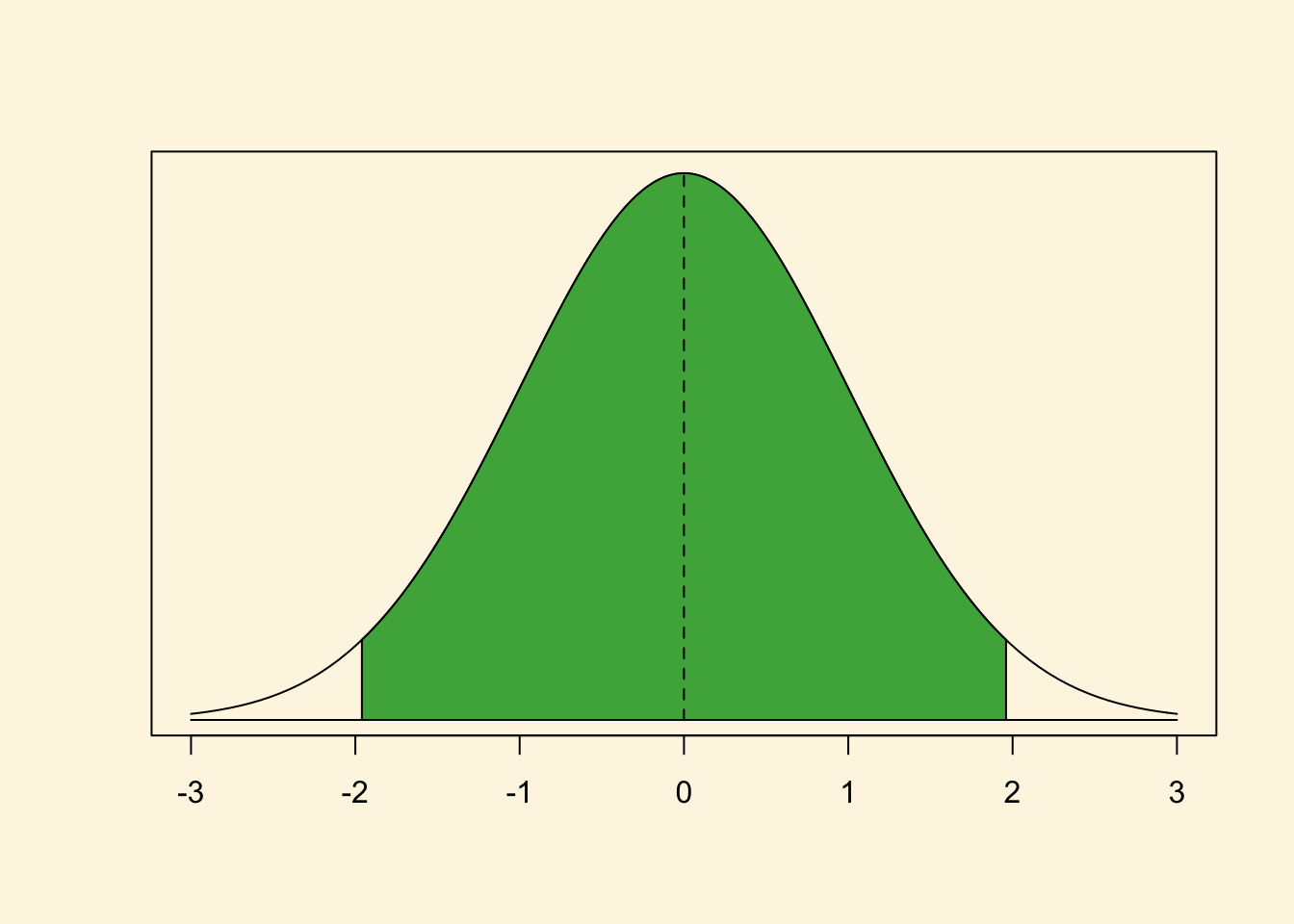

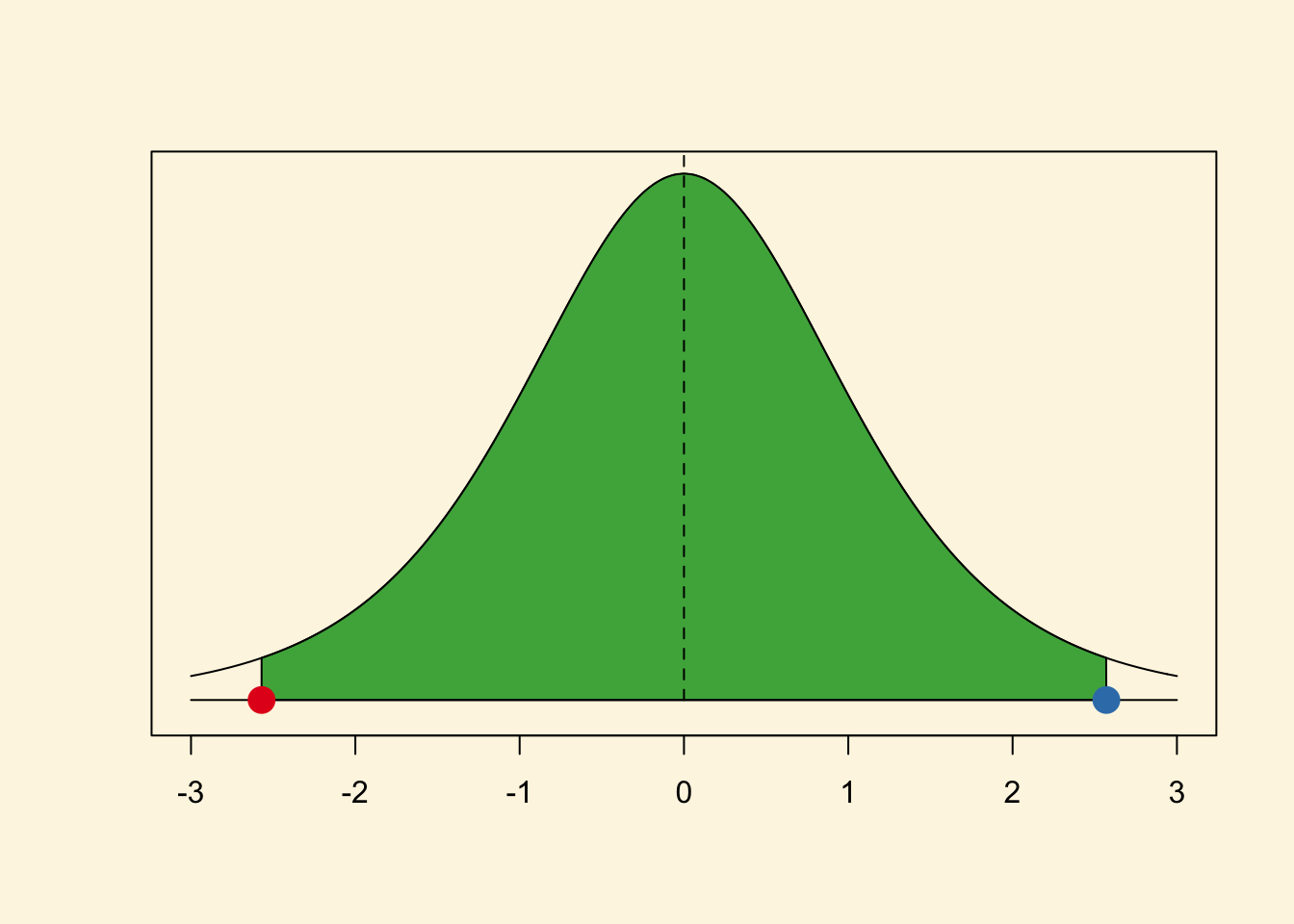

The green area under the curve covers 95 percent of all observations. There are 2.5 percent in each tail. We reject the null hypothesis if our estimate is in the tails of the distribution. It must be further than 1.96 standard deviations from the mean. But how did we know that 95 percent of the area under the curve is within 1.96 standard deviations from the mean?

Separate the curve in your mind into 3 pieces. The left tail covers 2.5 percent of the area under the curve. The green middle bit covers 95 percent and the right tail again 2.5 percent. Now think of these as cumulative probabilities. The left tail ends at 2.5 percent cumulative probability. The green area ends at 97.5 percent cumulative probability and the right tail ends at 100 percent.

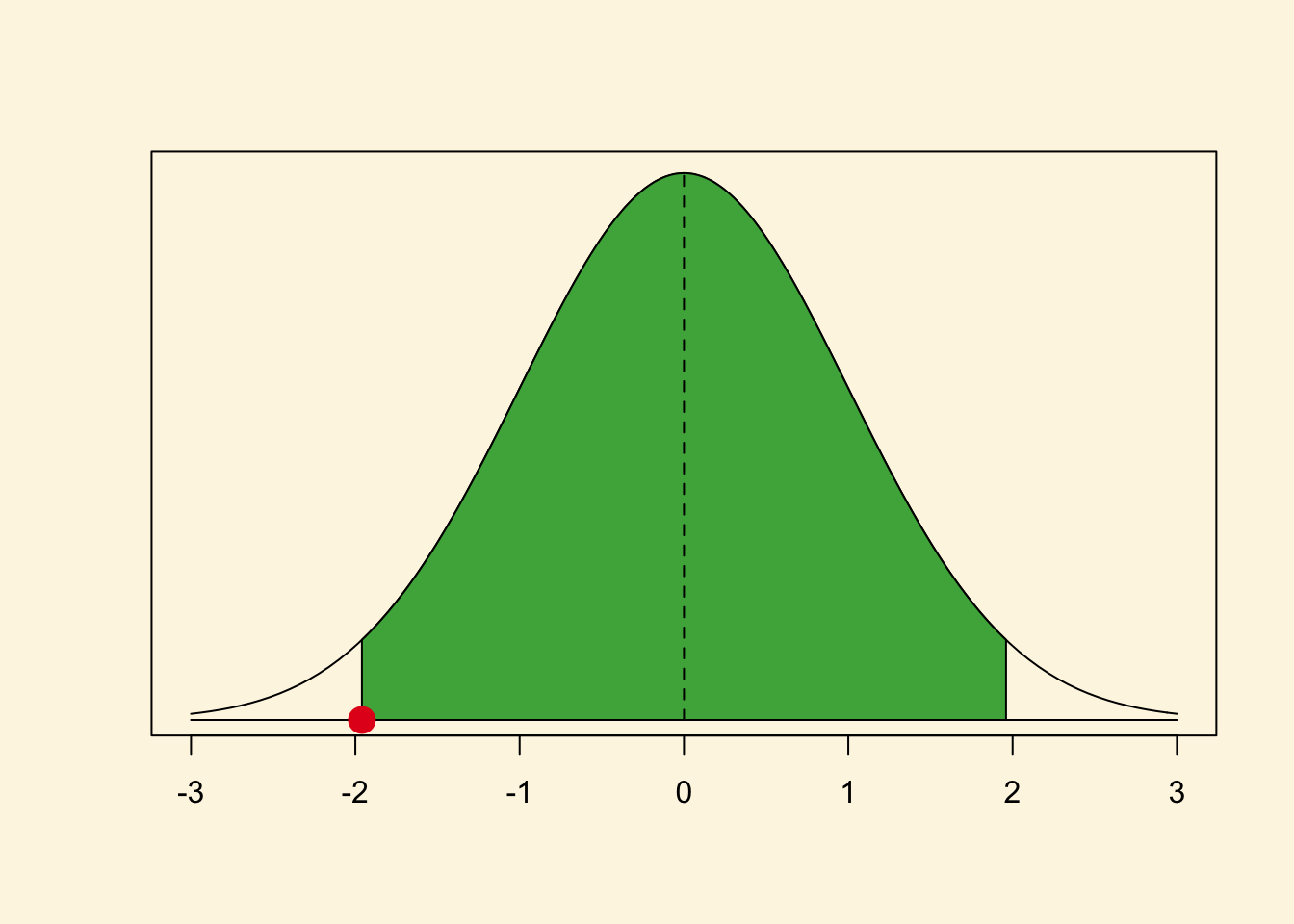

The critical value is were the left tail ends or the right tail starts (looking at the curve from left to right). Let’s get the value where the cumulative probability is 2.5 percent—where the left tail ends.

qnorm(0.025, mean = 0, sd = 1)[1] -1.959964If you look at the x-axis of our curve that is indeed where the left tail ends. We add a red dot to our graph to highlight it.

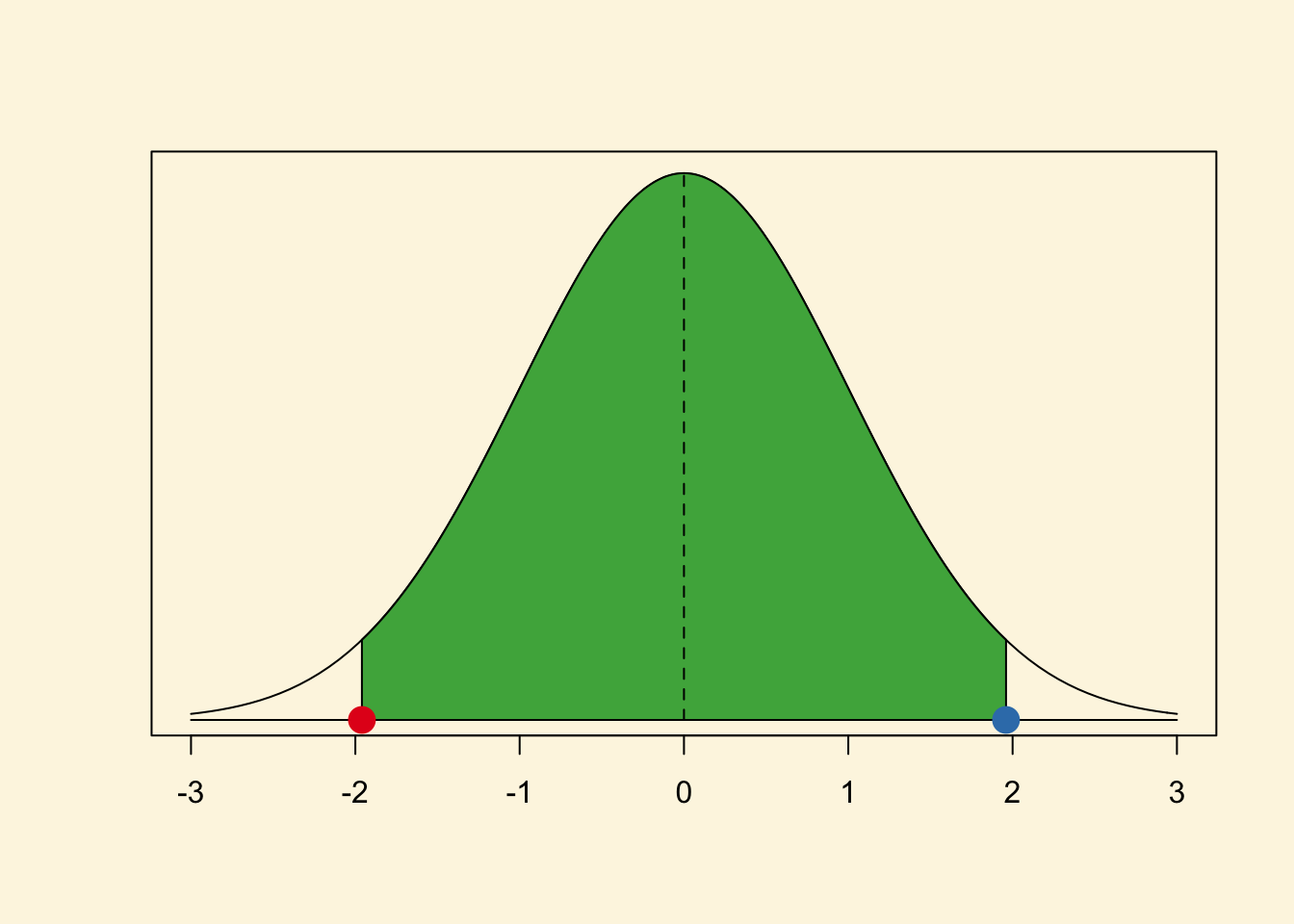

Now, let’s get the critical value of where the right tail starts. That is at the cumulative probability of 97.5 percent.

qnorm(0.975, mean = 0, sd = 1)[1] 1.959964As you can see, this is the same number, only positive instead of negative. That’s always the case because the normal distribution is symmetrical. Let’s add that point in blue to our graph.

This is how we get the critical value for the 95 percent confidence interval. Back in the day you would have had to look up critical values in critical values tables at the end of statistics textbooks (you can find the tables in Kellstedt and Whitten, for example).

As you can see our red and blue dots are the borders of the green area, the 95 percent interval around the mean. You can get the critical values for any other interval (e.g., the 99 percent interval) similar to what we did just now.

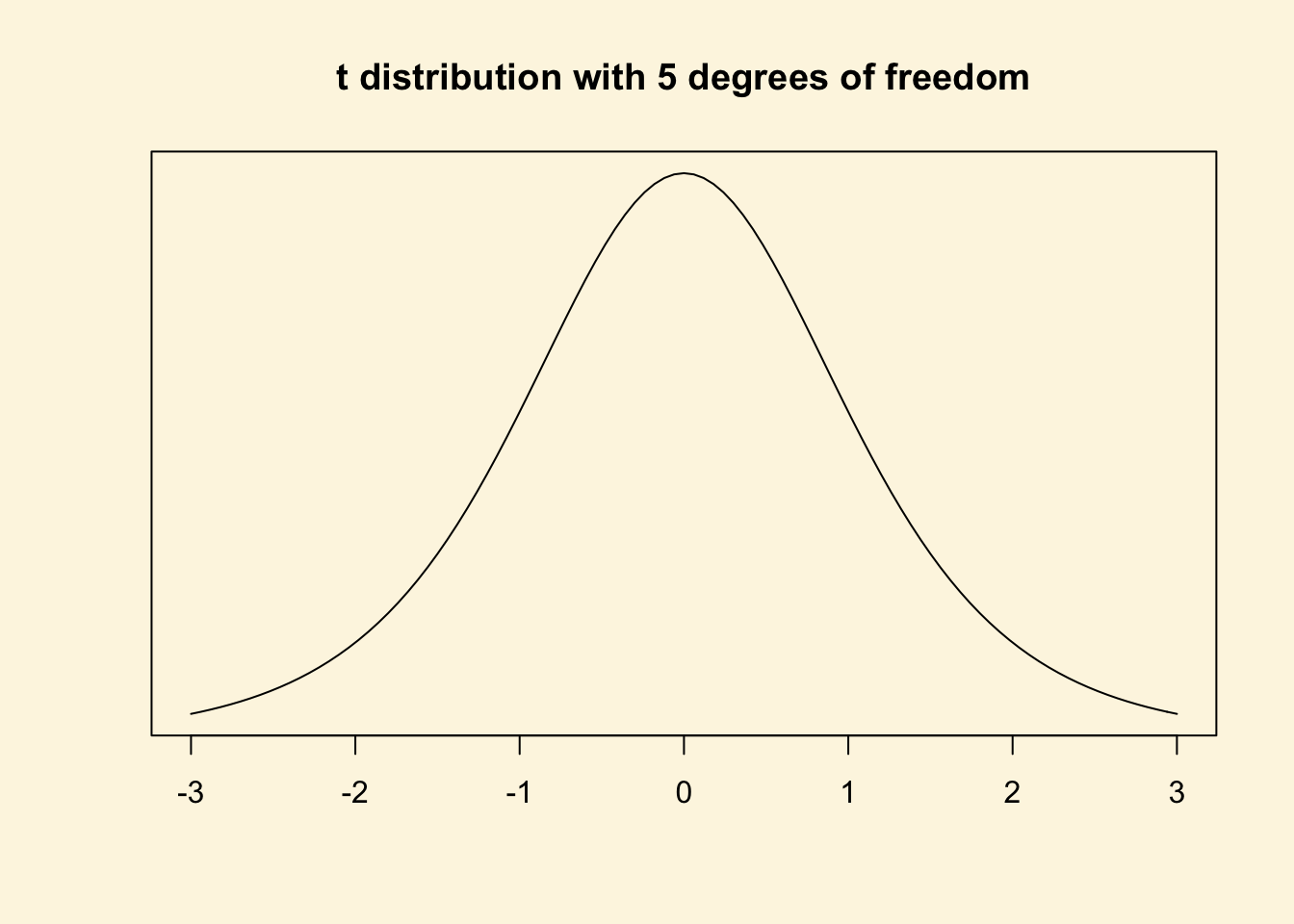

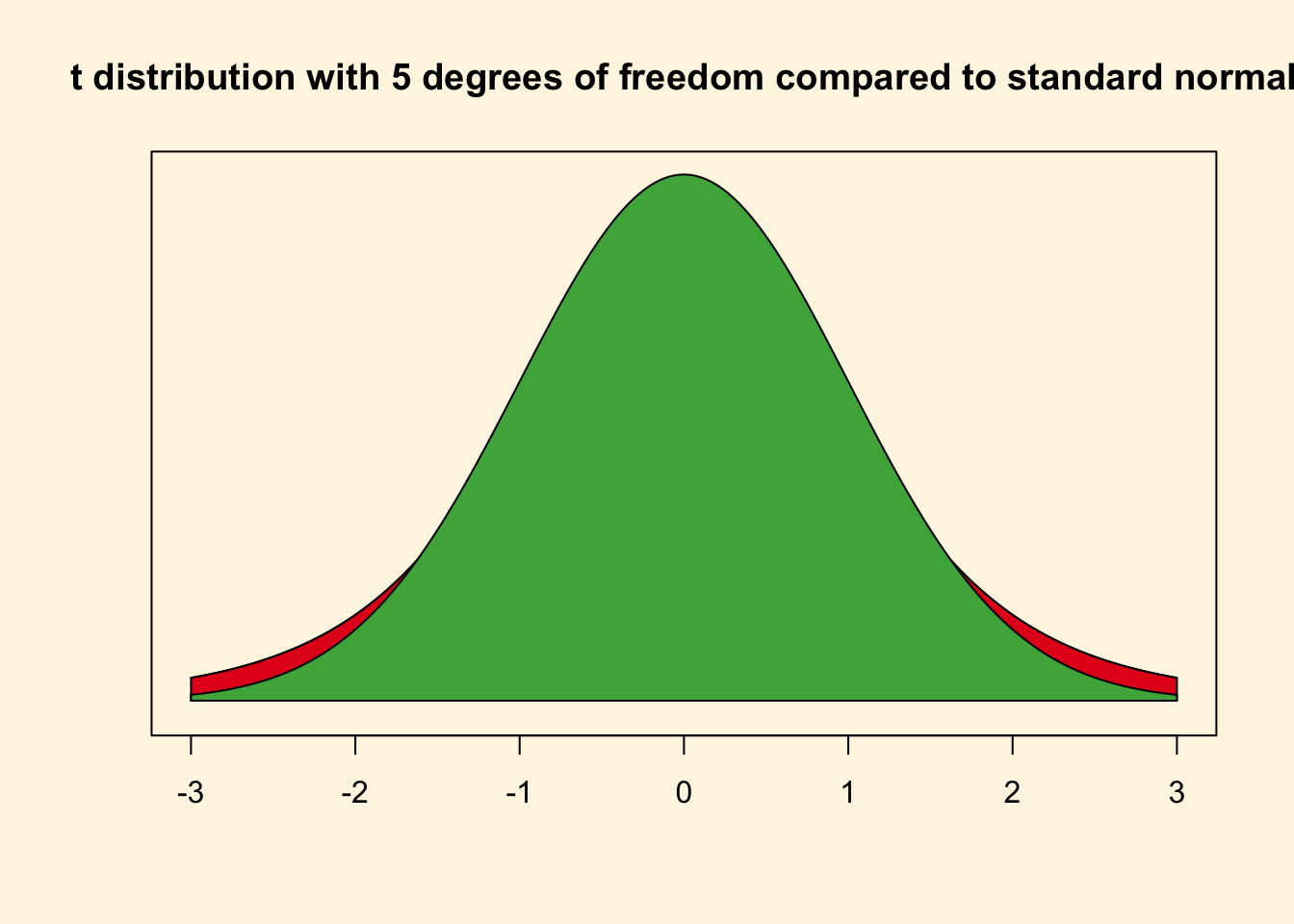

We now do the same for the t distribution. In the t distribution, the critical value depends on the shape of the t distribution which is characterised by its degrees of freedom. Let’s consider a t distribution with 5 degrees of freedom.

Although, it looks like a standard normal distribution, it is not. The t with 5 degrees of freedom has fatter tails. We show this by overlaying the t with a standard normal distribution.

The red area is the difference between the standard normal distribution and the t distribution with 5 degrees of freedom.

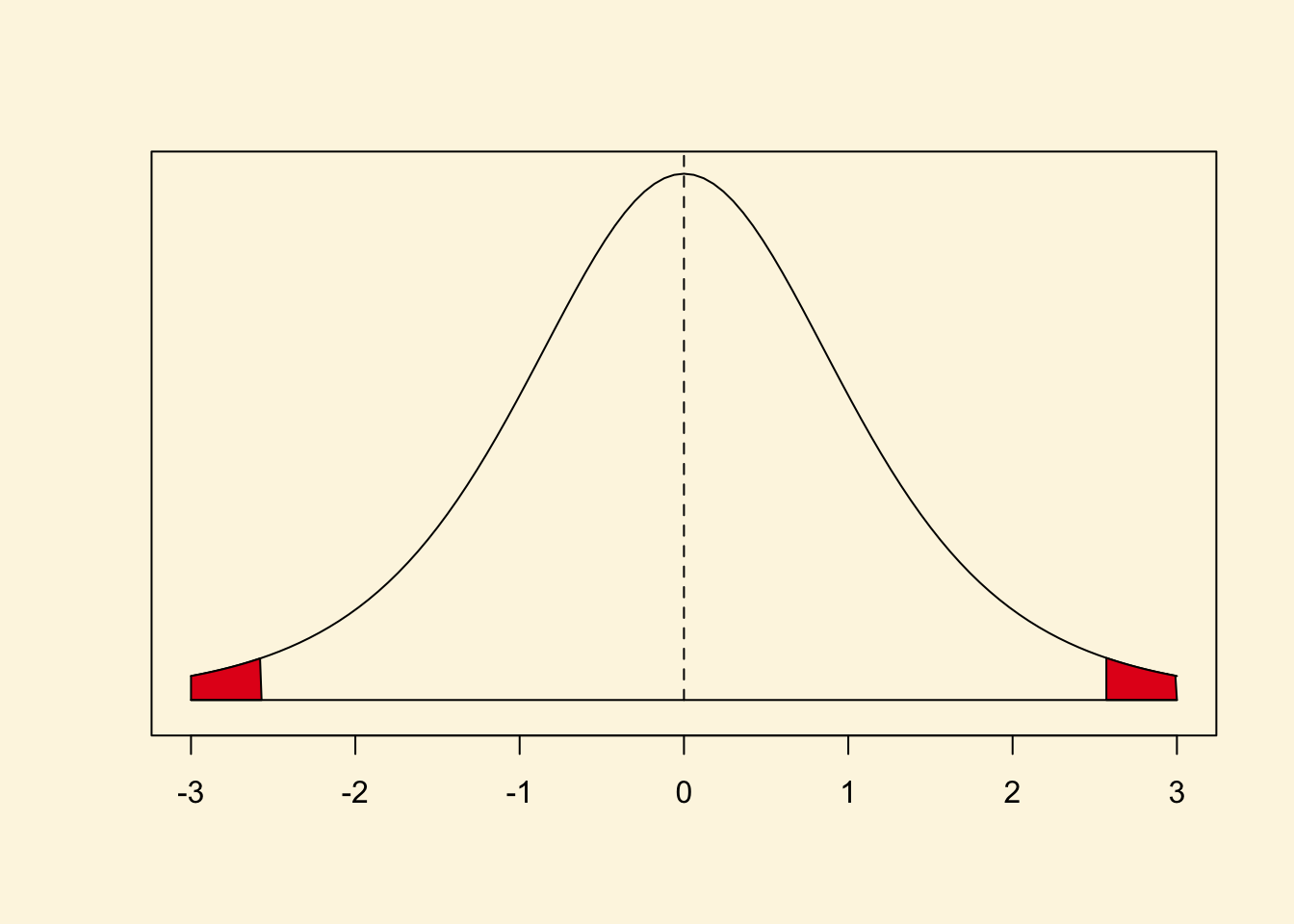

The tails are fatter and that means that the probabilities of getting a value somewhere in the tails is larger. Lets calculate the critical value for a t distribution with 5 degrees of freedom.

# value for cumulative probability 95 percent in the t distribution with 5 degrees of freedom

qt(0.975, df = 5)[1] 2.570582See how much larger that value is than 1.96. Under a t distribution with 5 degrees of freedom 95 percent of the observations around the mean are within the interval from negative 2.5705818 to positive 2.5705818.

Let’s illustrate that.

Remember the critical values for the t distribution are always more extreme or similar to the critical values for the standard normal distribution. If the t distribution has few degrees of freedom, the critical values (for the same percentage area around the mean) are much more extreme. If the t distribution has many degrees of freedom, the critical values are very similar.

6.1.3 T-test (difference in means)

We are interested in whether there is a difference in income between countries that have an independent judiciary and countries that do not have an independent judiciary. Put more formally, we are interested in the difference between two conditional means. Recall that a conditional mean is the mean in a subpopulation such as the mean of income given that the country has a free judiciary (conditional mean 1).

The t-test is the appropriate test statistic. Our interval-level dependent variable is wealth which is GDP per capita taken from the World Development Indicators of the World Bank. Our binary independent variable is h_j which is 1 if a country has a free judiciary and 0 otherwise.

Let’s check the summary statistics of our dependent variable GDP per captia using summary().

summary(world.data$wealth) Min. 1st Qu. Median Mean 3rd Qu. Max.

226.2 1768.0 5326.1 10184.1 12976.5 63686.7 Someone claims that countries with free judiciaries are usually richer than countries with controlled judiciaries. From the output of the summary() fucntion, we know that average wealth is 10184.0910395 US dollars across all countries — countries with and without free judiciaries.

Use the which() to get the row numbers of countries with free judiciaries.

which(world.data$h_j==1) [1] 8 9 13 14 18 23 28 33 39 40 41 42 43 44 50 52 54 55 60

[20] 70 71 72 74 75 76 77 80 82 84 85 90 93 94 104 105 107 110 112

[39] 114 115 118 126 127 131 143 144 145 146 149 153 154 155 157 160 163 165 166

[58] 167 168 169 170 171 178Now, all we need is to index the dataset like we did last week. We access the variable that we want (wealth) with the dollar sign and the rows in square brackets. Take the mean of wealth for countries with a free judiciary on your own.

We want to get the mean of wealth, but only over these rows. There are several ways to do this. The tidyverse has a nice option using group_by() and summarise(), building on what we have done in previous weeks.

# tidyverse grouped means

judiciary_means <- # assign to object

world.data %>% # pipe dataset

group_by(h_j) %>% # group by whether countries have free judiciary

summarise(mean = mean(wealth), # get mean of wealth for each group

n = n()) # also get number of observations in each group

judiciary_means# A tibble: 3 x 3

h_j mean n

<int> <dbl> <int>

1 0 5885. 99

2 1 17827. 63

3 NA 6693. 16We can run a t-test on the data by filtering the dataset according to judiciary status.

free_jud <- world.data %>%

filter(h_j == 1)

cont_jud <- world.data %>%

filter(h_j == 0)

# t.test for the difference between 2 means

t.test(free_jud$wealth, # mean 1

cont_jud$wealth, # mean 2

mu = 0, # difference under the null hypothesis

alt = "two.sided", # two sided test (difference in means could be smaller or larger than 0)

conf = 0.95) # confidence interval

Welch Two Sample t-test

data: free_jud$wealth and cont_jud$wealth

t = 6.0094, df = 98.261, p-value = 0.00000003165

alternative hypothesis: true difference in means is not equal to 0

95 percent confidence interval:

7998.36 15885.06

sample estimates:

mean of x mean of y

17826.591 5884.882 There is another way to do this, which is quicker and means you do not have to subset the data beforehand. Instead, you use a formula syntax to see how your dependent variable (here wealth) varies between the levels of your independent variable (here h_j). The dependent variable goes before a tilde (~) and the independent variable comes after. So what we are doing here is taking a continuous variable and comparing its means in different groups of a binary nominal variable to see if there is a significant, systematic difference between those groups.

# t.test for the difference between 2 means

t.test(world.data$wealth ~ world.data$h_j, # formula y ~ x

mu = 0, # difference under the null hypothesis

alt = "two.sided", # two sided test (difference in means could be smaller or larger than 0)

conf = 0.95) # confidence interval

Welch Two Sample t-test

data: world.data$wealth by world.data$h_j

t = -6.0094, df = 98.261, p-value = 0.00000003165

alternative hypothesis: true difference in means is not equal to 0

95 percent confidence interval:

-15885.06 -7998.36

sample estimates:

mean in group 0 mean in group 1

5884.882 17826.591 # alternatively, specify the data in the 'data' argument and no need for dollar signs

t.test(wealth ~ h_j, # formula y ~ x

data = world.data, # data

mu = 0, # difference under the null hypothesis

alt = "two.sided", # two sided test (difference in means could be smaller or larger than 0)

conf = 0.95) # confidence interval

Welch Two Sample t-test

data: wealth by h_j

t = -6.0094, df = 98.261, p-value = 0.00000003165

alternative hypothesis: true difference in means is not equal to 0

95 percent confidence interval:

-15885.06 -7998.36

sample estimates:

mean in group 0 mean in group 1

5884.882 17826.591 Let’s interpret the results you get from t.test(). The first line tells us which groups we are comparing. In our example: Do countries with independent judiciaries have different mean income levels than countries without independent judiciaries?

In the following line you see the t-value, the degrees of freedom and the p-value. Knowing the t-value and the degrees of freedom you can check in a table on t distributions how likely you were to observe this data, if the null-hypothesis was true. The p-value gives you this probability directly. For example, a p-value of 0.02 would mean that the probability of seeing this data given that there is no difference in incomes between countries with and without independent judiciaries in the population, is 2%. Here the p-value is much smaller than this: 3.165e-08 = 0.00000003156!

In the next line you see the 95% confidence interval because we specified conf=0.95. If you were to take 100 samples and in each you checked the means of the two groups, 95 times the difference in means would be within the interval you see there.

At the very bottom you see the means of the dependent variable by the two groups of the independent variable. These are the means that we estimated above. In our example, you see the mean income levels in countries were the executive has some control over the judiciary, and in countries were the judiciary is independent.

Note that we are analysing a bivariate relationship. The dependent variable is wealth and the independent variable is h_j.

Furthermore, note that in the t test for the differences in means, the degrees of freedom depend on the variances in each group. You do not have to compute degrees of freedom for t tests for the differences in means yourself in this class — just use the t.test() function.

6.1.4 Estimating p values from t values

Estimating the p value is the reverse of getting a critical value. We have a t value and we want to know what the probability is to get such a value or an even more extreme value.

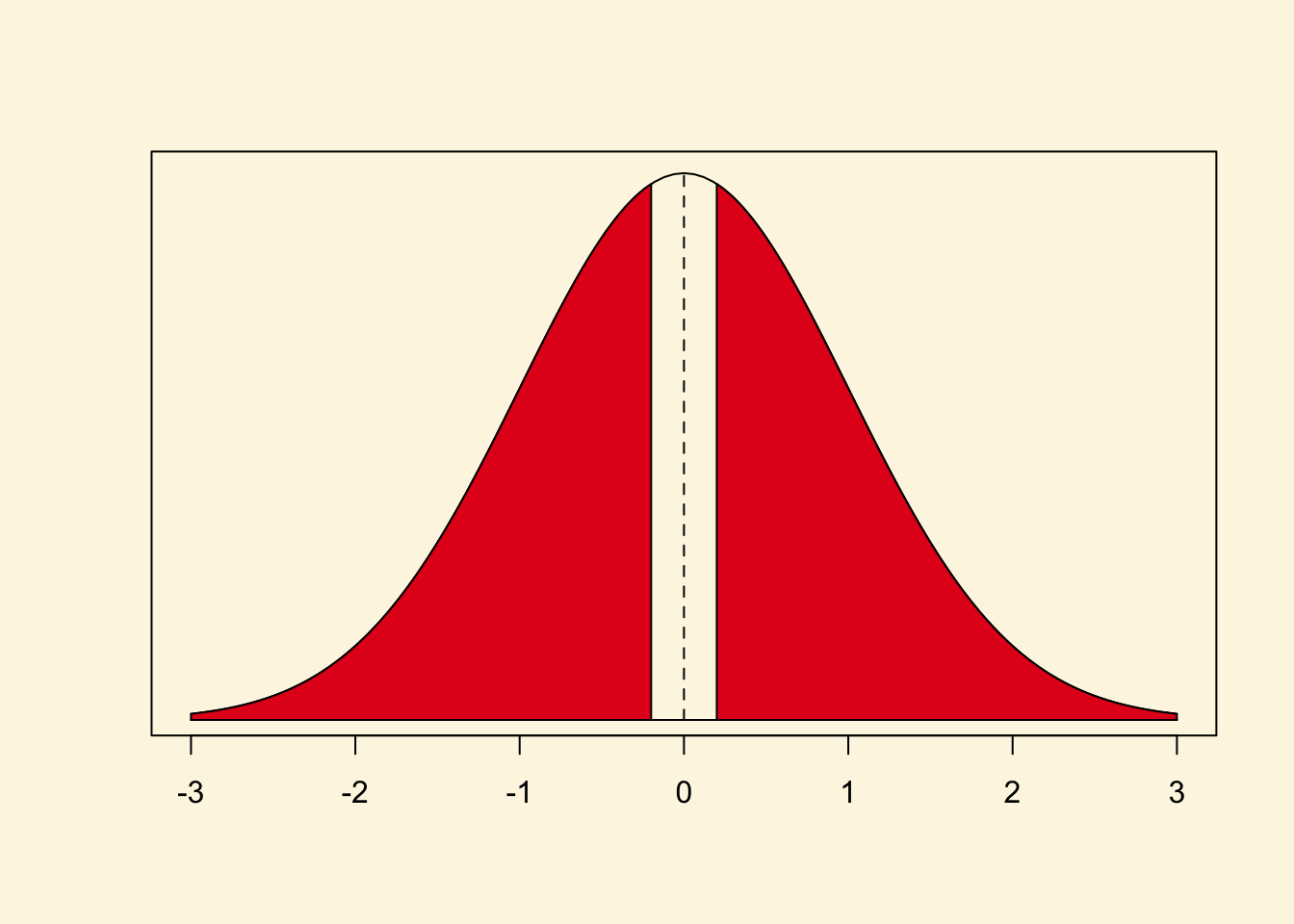

Let’s say that we have a t distribution with 5 degrees of freedom. We estimated a t value of 2.9. What is the corresponding p value?

(1 - pt(2.9, df = 5)) *2[1] 0.0337907This is the probability of getting a t value of 2.9 or larger (or -2.9 or smaller) given that the null hypothesis is true. pt(2.9, df = 5) is the cumulative probability of getting a t value of 2.9 or smaller. But we want the probability of getting a value that is as large (extreme) as 2.9 or as small as -2.9. Therefore, we do 1 - pt(2.9, df = 5). We multiply by 2 to get both tails (1 - pt(2.9, df = 5))*2. This is the probability of getting a t value in the red tails of the distribution if the null hypothesis was true.

Clearly, the probability of getting such an extreme value (or something larger) under the assumption that the null hypothesis is true is very unlikely. The exact probability is ~0.03 (3 percent). We, therefore, think that the null hypothesis is false.

Let’s estimate the p value in a normal distribution (it’s actually better to always use the t distribution but the difference is negligible if the t distribution has many degrees of freedom).

Let’s take our earlier example where we had estimated a t value of 0.1995059. Your friend claimed world income is 10 000 per capita on average and you estimated something slightly larger.

Let’s check what the exact p value is in a normal distribution given a t value of 0.1995059.

(1 - pnorm(0.1995059))*2[1] 0.841867

Clearly, it was not very unlikely to find a t value of 0.1995059 (that’s the absolute value, i.e., a t value of negative or postive 0.1995059) under the assumption that the null hypothesis is true. Therefore, we cannot reject the null. The probability is 0.84 (84 percent)—highly likely.

6.1.5 Exercises

- Find the means of political stability in countries that (1) were former colonies, (2) were not former colonies. Hint: it will be useful to turn

former_colinto a factor variable for this, something we have done in previous seminars. - Is the the difference in means statistically significant at an alpha level of 0.05? And at 0.01?

- Check the claim that the true population mean of

undp_hdiis 0.85, reporting and interpreting the t statistic and the p value. - An angry citizen who wants to defund international development claims that countries that were former colonies have reached 75% of the level of wealth of countries that were not colonised. Assess this claim statistically.